First 2 pictures of what will seem some unassuming factories, bear with me

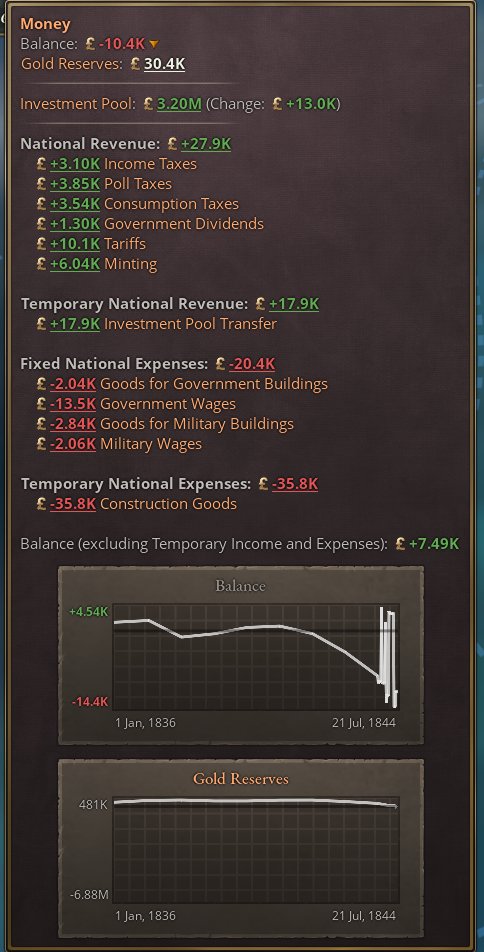

2 shipyards, working at high throughput employing 16.000 people in between them in a environment of high labor competition. What is more peculiar about these factories is that the sole fashion upon which the state takes income or gain from those factories is trough tariffs. We dont have income tax or any other form of tax in our nation, just tariffs. And the thing here is that the ships are pretty much all produced for export, and sold at a 15% export tariff, but in fact the input resources they use and which as you might have noticed are rather expensive are also pretty much all imported and this over a 45% import tariff.

As a result, we can make a breakdown o what these 2 factories bring in for us, the state, trough tariffs:

Not only do we need to consider the export tariffs on the ships, which can all be traced back to these factories as they are pretty much the sole ship producers in my country, but also the tariff levied on the imports, it breaks down as folows:

1400£ for the sales of man-o-wars

1730£ for the sales of Clippers

450£ for the import of engines, fully utilized by these factories

800£ roughly for the hardwood, as these factories consume 95% of the imports

700£ roughly for the imports of fabrics, these factories consume 20% of the volume imported

100£ each on wood and iron, since we actually also produce some ourselves and they dont use much of that

Which brings us to a grand total of 5180£ of tariffs, levied on products with a total market revenue of 20.800£.

Thats a lot of money for the state, a LOT.

Lets say per comparison that the state would want to earn money on those factories trough state dividends, then given that these 2 factories have a rather fine 3000£ of dividend spread between them that the state could perhaps get about 1000£ in dividend at a 30% divident rate ... it doesnt compare, and take in mind that state ownership would clash with the throughput delivered by the company.

If we look at it from the perspective of tax, then it's also fairly easy to calculate. My pops here have triple the wages as say a shipyard in London, and yet their total wages spread among two factories constitutes a total of about 2300£. the mid level of Per capita tax levies a 15% inccome tax, so the income tax taken from such wages would yield 345£

So if you were just taxing this and taking a dividend in a autartic system were all imputs are produced by the nation ann all outputs consumed for the nations use, 1345£ is a rough ballpark of what you might get as the state for having 16k of your laborpool employed. Compare this to the 5180£ we earn here, well 5180£ is four times that kind of money that the state earns per worker employed. Especially handy then for country's of more diminutive size that have limited manpower to work with.

Now take in mind that the ones who pay most in this system are kinda the factory owners, as they in part pay for the overpriced import goods yet their business is profitable enough to bear that burden so ... it works. They are still getting fairly rich from this operation, and the workers are payed well. The workers afcourse neither pay taxes, which drives their consumption rates higher.

Further conclusions can be derived from looking at how high input prices affect tariffs. They dont. On the of the 21K revenue the factorys make selling between them at average market price, 14000+1730£ is a fairly logical income for its output, it constitutes roughly 15 % as the export tariff suggests of that revenue minus the ships i consume myself. It's the same for the input of cloth which is about as 1670£ and on which i gain at 45% a rough 700£ in tariffs. But i dont make the 45% on the costs made on engines by these factories, not by far, and thats because they are overpriced. The tariffs are thus levied at normal market price, all the extra of a high priced good goes, kinda logically, to the actual seller. The utility of having those goods cheaper then is for the purpose of making the factory more competitive. But take in mind that therefore the inverse is also true. If i am selling coffee as the state to a country at -75% market price, then the 15% tariff levied on the product is calculated on the normal price not this reduced market price. So if you have significant competitive advantages as an agricultural producer that however require you to really push the price down to be competitive then know that nevertheless the size of that 15% export tariff gotten will be pretty neato given its calculated at normal price, in this case the buyer gets the advantage of a cheaper good but not a cheaper tariff.

One can understand that in this sort of system, what we really want to produce is foremost things that pop dont consume and require industrial resources at it. We want to import as much as we can, as we can slap a high tariff to it, but preferably on consumption goods ofcourse, and then on input resources too. So what we rather prefer is really highly effecient non consumer good producing factories, and a sufficient trade network to both get the materials from and sell the output. Not much if anything in terms of mines or farms or whatever, a limited sellection of highly effecient company supported industires.

General arms industry (providing you also focus a bit on mil tech) is kinda perfect, even though the market is somewhat limited, especially for small country's that relative limited market can be big enough for them and provide huge income at it. This is because the price and volume of their output good constitutes a lot of money on a per worker basis. But certain bulk agricultural goods like dyes that have an industrial nature can be fine too, if you can drop of thousands on markets from really cheap producing high throughput farms for example.

For small country's, i have experimented on this with negative bureaucracy. But it doesnt have to be nessecary on negative buraucracy. The thing is that even for large country's that suffer from large tax waste, there is a certain way into this. I call it "labor intensive administration", there is a peculiarity in buraucracy's in that extra buraucracy gained from utilizing paper scales up far slower than extra tax capacity gain. That means that buraucracys that are purposedly held "paper less" and are overbuild to get more buraucracy and tax effeciency trough sheer throughput are actually more effecient at generating sheer volumes of buraucracy but not tax capacity. If it were for the sheer tax capacity, large natiosn with lots of tax waste like China would need more advanced paper using buraucracies, if however China would opt to produce sheer administration out of its administrations and then use it to set up huge trade neworks to make huge gains on tariffs then it could do that while keeping buraucracy positive and then thus also take in a lot more tax too. given that buraucracies are cheap nowadays sonce latest patches, paperless buraucracies have become an option for such nations to combine ineffecient tax capacity with a big chunk of added tariff income.

there are a number of things i still have to experiment here. As a power block, one can get an institution like internal trade level 3 where 20% tariffs are levied from outside the power block both on imports and exports. the questin i have is how this combiens with free trade and trade agreements. it would perhaps be the sweet spot that you would have this and then free trade and free trade agreements and your still levying 20% tariffs. Also, treaty ports rock, i didnt play much with treaty ports before but i can call for some re-apreciation of them. treaty ports are also rebellion free, quite nice, but afcourse the main use is to circumvent the tariffs levied by the one you trade to, after which maintaining a 20% tariff in combination with free trade should make it easy to compete on their market i reckon.

2 shipyards, working at high throughput employing 16.000 people in between them in a environment of high labor competition. What is more peculiar about these factories is that the sole fashion upon which the state takes income or gain from those factories is trough tariffs. We dont have income tax or any other form of tax in our nation, just tariffs. And the thing here is that the ships are pretty much all produced for export, and sold at a 15% export tariff, but in fact the input resources they use and which as you might have noticed are rather expensive are also pretty much all imported and this over a 45% import tariff.

As a result, we can make a breakdown o what these 2 factories bring in for us, the state, trough tariffs:

Not only do we need to consider the export tariffs on the ships, which can all be traced back to these factories as they are pretty much the sole ship producers in my country, but also the tariff levied on the imports, it breaks down as folows:

1400£ for the sales of man-o-wars

1730£ for the sales of Clippers

450£ for the import of engines, fully utilized by these factories

800£ roughly for the hardwood, as these factories consume 95% of the imports

700£ roughly for the imports of fabrics, these factories consume 20% of the volume imported

100£ each on wood and iron, since we actually also produce some ourselves and they dont use much of that

Which brings us to a grand total of 5180£ of tariffs, levied on products with a total market revenue of 20.800£.

Thats a lot of money for the state, a LOT.

Lets say per comparison that the state would want to earn money on those factories trough state dividends, then given that these 2 factories have a rather fine 3000£ of dividend spread between them that the state could perhaps get about 1000£ in dividend at a 30% divident rate ... it doesnt compare, and take in mind that state ownership would clash with the throughput delivered by the company.

If we look at it from the perspective of tax, then it's also fairly easy to calculate. My pops here have triple the wages as say a shipyard in London, and yet their total wages spread among two factories constitutes a total of about 2300£. the mid level of Per capita tax levies a 15% inccome tax, so the income tax taken from such wages would yield 345£

So if you were just taxing this and taking a dividend in a autartic system were all imputs are produced by the nation ann all outputs consumed for the nations use, 1345£ is a rough ballpark of what you might get as the state for having 16k of your laborpool employed. Compare this to the 5180£ we earn here, well 5180£ is four times that kind of money that the state earns per worker employed. Especially handy then for country's of more diminutive size that have limited manpower to work with.

Now take in mind that the ones who pay most in this system are kinda the factory owners, as they in part pay for the overpriced import goods yet their business is profitable enough to bear that burden so ... it works. They are still getting fairly rich from this operation, and the workers are payed well. The workers afcourse neither pay taxes, which drives their consumption rates higher.

Further conclusions can be derived from looking at how high input prices affect tariffs. They dont. On the of the 21K revenue the factorys make selling between them at average market price, 14000+1730£ is a fairly logical income for its output, it constitutes roughly 15 % as the export tariff suggests of that revenue minus the ships i consume myself. It's the same for the input of cloth which is about as 1670£ and on which i gain at 45% a rough 700£ in tariffs. But i dont make the 45% on the costs made on engines by these factories, not by far, and thats because they are overpriced. The tariffs are thus levied at normal market price, all the extra of a high priced good goes, kinda logically, to the actual seller. The utility of having those goods cheaper then is for the purpose of making the factory more competitive. But take in mind that therefore the inverse is also true. If i am selling coffee as the state to a country at -75% market price, then the 15% tariff levied on the product is calculated on the normal price not this reduced market price. So if you have significant competitive advantages as an agricultural producer that however require you to really push the price down to be competitive then know that nevertheless the size of that 15% export tariff gotten will be pretty neato given its calculated at normal price, in this case the buyer gets the advantage of a cheaper good but not a cheaper tariff.

One can understand that in this sort of system, what we really want to produce is foremost things that pop dont consume and require industrial resources at it. We want to import as much as we can, as we can slap a high tariff to it, but preferably on consumption goods ofcourse, and then on input resources too. So what we rather prefer is really highly effecient non consumer good producing factories, and a sufficient trade network to both get the materials from and sell the output. Not much if anything in terms of mines or farms or whatever, a limited sellection of highly effecient company supported industires.

General arms industry (providing you also focus a bit on mil tech) is kinda perfect, even though the market is somewhat limited, especially for small country's that relative limited market can be big enough for them and provide huge income at it. This is because the price and volume of their output good constitutes a lot of money on a per worker basis. But certain bulk agricultural goods like dyes that have an industrial nature can be fine too, if you can drop of thousands on markets from really cheap producing high throughput farms for example.

For small country's, i have experimented on this with negative bureaucracy. But it doesnt have to be nessecary on negative buraucracy. The thing is that even for large country's that suffer from large tax waste, there is a certain way into this. I call it "labor intensive administration", there is a peculiarity in buraucracy's in that extra buraucracy gained from utilizing paper scales up far slower than extra tax capacity gain. That means that buraucracys that are purposedly held "paper less" and are overbuild to get more buraucracy and tax effeciency trough sheer throughput are actually more effecient at generating sheer volumes of buraucracy but not tax capacity. If it were for the sheer tax capacity, large natiosn with lots of tax waste like China would need more advanced paper using buraucracies, if however China would opt to produce sheer administration out of its administrations and then use it to set up huge trade neworks to make huge gains on tariffs then it could do that while keeping buraucracy positive and then thus also take in a lot more tax too. given that buraucracies are cheap nowadays sonce latest patches, paperless buraucracies have become an option for such nations to combine ineffecient tax capacity with a big chunk of added tariff income.

there are a number of things i still have to experiment here. As a power block, one can get an institution like internal trade level 3 where 20% tariffs are levied from outside the power block both on imports and exports. the questin i have is how this combiens with free trade and trade agreements. it would perhaps be the sweet spot that you would have this and then free trade and free trade agreements and your still levying 20% tariffs. Also, treaty ports rock, i didnt play much with treaty ports before but i can call for some re-apreciation of them. treaty ports are also rebellion free, quite nice, but afcourse the main use is to circumvent the tariffs levied by the one you trade to, after which maintaining a 20% tariff in combination with free trade should make it easy to compete on their market i reckon.

Attachments

Last edited:

- 5

- 1